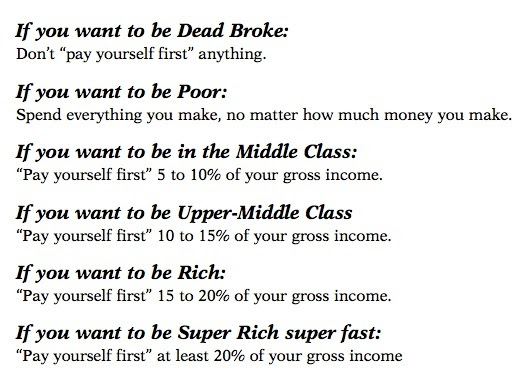

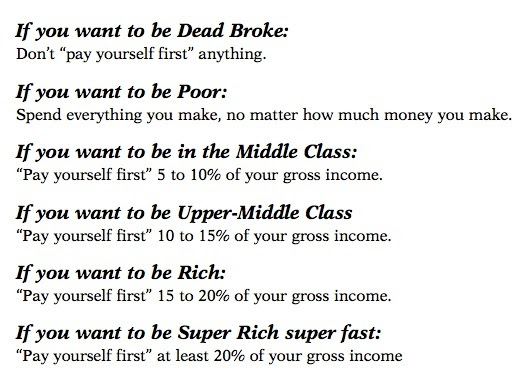

Save by paying yourself is critical to growing your wealth.

There are some simple rules to create prior to setting up a system to pay yourself.

1. To save properly, it’s best to plan then allow it to be automated.

It’s too easy to spend money that’s in an account or feel comfortable making large purchases when you see cash that is sitting idle. Instead, when you put saving on autopilot, you’ll soon view the entire account as a savings account that is intended to increase your wealth.

2. The number one rule of this new account is to take NO WITHDRAWS to any account that you spend out of. You may transfer funds from this account to another wealth generation account once per year. You’ll likely need separate accounts to invest the funds.

Other than those transfers, this account is not where you save for large purchases or vacations. This isn’t an emergency fund. This is a wealth fund. The balance in the wealth funds should increase each year.

3. These funds should be invested in low risk investments. This is the only way to make sure the account balance increases each year.

Too many people look at wealth as an all or nothing game. We know you can’t coupon your way to it, but it is a gradual, long-term project.

If you think you will strike it rich with high-risk investments, this account could easily go down in value (possibly to zero).

Once again, these savings are a wealth account, not an investment account. With the power of compounding, you need to only earn 5% per year to become a millionaire over time. If you aim for unrealistic returns, you put the account for unnecessary ups and downs.

This account is for bonds, dividend paying stocks, and investments with predictable, steady cash flows.

Don’t view it any other way.

There are some simple rules to create prior to setting up a system to pay yourself.

1. To save properly, it’s best to plan then allow it to be automated.

It’s too easy to spend money that’s in an account or feel comfortable making large purchases when you see cash that is sitting idle. Instead, when you put saving on autopilot, you’ll soon view the entire account as a savings account that is intended to increase your wealth.

2. The number one rule of this new account is to take NO WITHDRAWS to any account that you spend out of. You may transfer funds from this account to another wealth generation account once per year. You’ll likely need separate accounts to invest the funds.

Other than those transfers, this account is not where you save for large purchases or vacations. This isn’t an emergency fund. This is a wealth fund. The balance in the wealth funds should increase each year.

3. These funds should be invested in low risk investments. This is the only way to make sure the account balance increases each year.

Too many people look at wealth as an all or nothing game. We know you can’t coupon your way to it, but it is a gradual, long-term project.

If you think you will strike it rich with high-risk investments, this account could easily go down in value (possibly to zero).

Once again, these savings are a wealth account, not an investment account. With the power of compounding, you need to only earn 5% per year to become a millionaire over time. If you aim for unrealistic returns, you put the account for unnecessary ups and downs.

This account is for bonds, dividend paying stocks, and investments with predictable, steady cash flows.

Don’t view it any other way.

No comments:

Post a Comment